Bitcoin is the world’s first cryptocurrency (decentralized digital currency). This currency is fundamentally different from all previously created electronic currencies and payment systems. It is not tied to any physical assets or “official” currencies, and the price of the digital coin – bitcoin – is governed solely by market supply and demand.

Bitcoin is also a worldwide payment system through which you can conduct transactions with this currency. Its main difference from traditional payment systems is that the Bitcoin system does not have any control and processing center – all operations take place exclusively in a network of equal clients.

The history of the creation of bitcoin

According to legend, in 2008, an algorithm for the principles of the new financial system was developed by someone under the pseudonym Satoshi Nakamato. The protocol itself was completed in 2009 and the Bitcoin network was launched.

Bitcoin is a reward for an operation in the form of a code.

What operation?

Let’s say they send you money. There is a transaction of money from one wallet to yours. There are many such transfers on the network. These transactions are recorded, combined together into a special. structure – block.

Bitcoin transaction

The speed of creating one block is 10 min. (fixed)

The block size is 1 MB.

When one block is created, the formation of another begins … and so on.

When one block is created, the program pays a reward of 50 bitcoins until November 28, 2012. Until July 9, 2016, the reward was 25 bitcoins. After is 12.5 bitcoins….

This is due to the fact that after the formation of every 210,000 blocks (approximately once every 4 years) – the size of the reward with new bitcoins is halved, that is, this value is a decreasing geometric progression (the size of the reward is 50 → 25 → 12.5 → …).

The total supply of bitcoins is limited and will not exceed 21 million. As of August 2017, there were over 16 million bitcoins in circulation.

In 2031, the size of the issue during the creation of the block will be less than one bitcoin and will continue to go to zero. It is assumed that mining will stop in 2140, but long before that, fees will gradually become the main source of reward for the formation of new blocks.

Who gets paid for the job?

People (miners) who have equipment to help collect these transactions into a block. To close the block, the miners iterate over a number such that the hash sum of this block starts with 18 zeros. This is a rather expensive operation in terms of computing power, and moreover, the complexity is constantly growing.

Bitcoins are sent and received through software or websites called “Bitcoin wallets”. Wallets send and confirm transactions on the Bitcoin network using a “Bitcoin address,” a unique user ID on the network.

All transactions are stored in the so-called block chain.

Owning real capital is always a risk in terms of the laws of countries and taxation.

The owner of assets can always be sued, put under serious pressure, or forced to leave the country to seek political asylum in others.

Let’s list the options for how you can save such money in emergency situations:

- Precious metals, diamonds are inconvenient, it is impossible to cross the border with them, etc.

- Fiat currency – similarly inconvenient, you can’t take tons of pieces of paper with you anywhere

- Real estate, yachts, cars – it is easy to seize and you can say goodbye to it

- Securities, bonds, shares are also subject to various prohibitions, sanctions, arrests

- Non-cash funds in various banks (including offshore) – in recent years there has been an active struggle with them, all our favorite KYC, AML are aimed at them. This shop is gradually closing and funds can also be frozen.

And now let’s look at BITCOIN from this point of view

- No one can know what you have and how much

- No one will take it away if you yourself do not leak the private key

- You can take it with you anywhere in the world and carry it out by any means of transport with a smartphone or laptop.

- It cannot be seized or your access to it restricted

- It is as safe as possible

- You can send some amount in it from anywhere and to anywhere in the world without worrying that banks will freeze your payment

- Volatility… even if you were unlucky and bought bitcoin at 20k and sold it at 3.2k, you still have 16% of your funds. But you could lose everything if you used the above methods of storing funds.

Every year more and more people understand this. And investing 5-10% of your capital in bitcoin, for a rainy day, turns out to be a no-alternative solution.

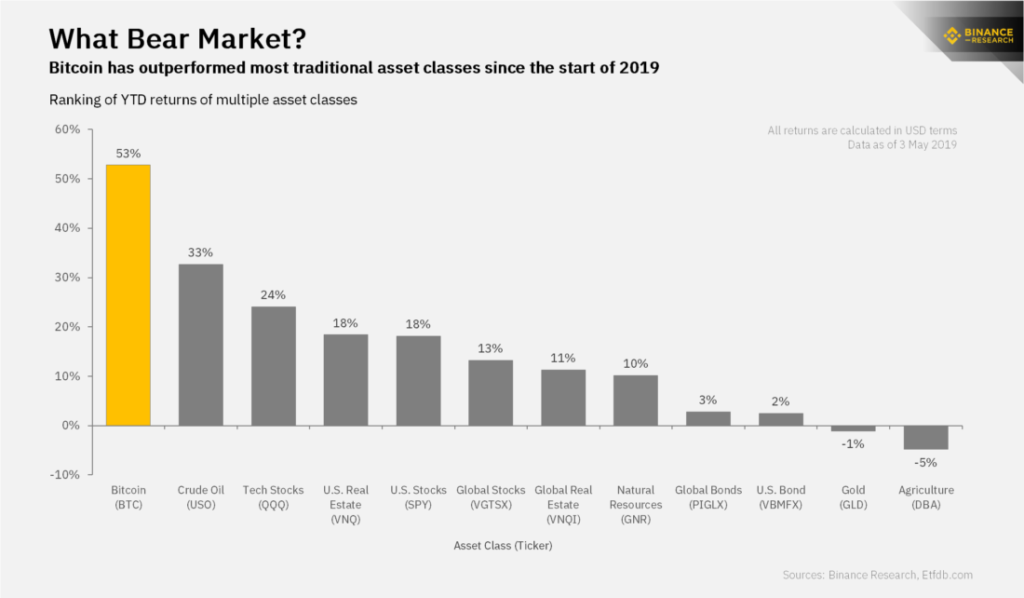

The picture shows what is actually happening: